The Hidden Fees Banks Don’t Tell You About When Exchanging Currency

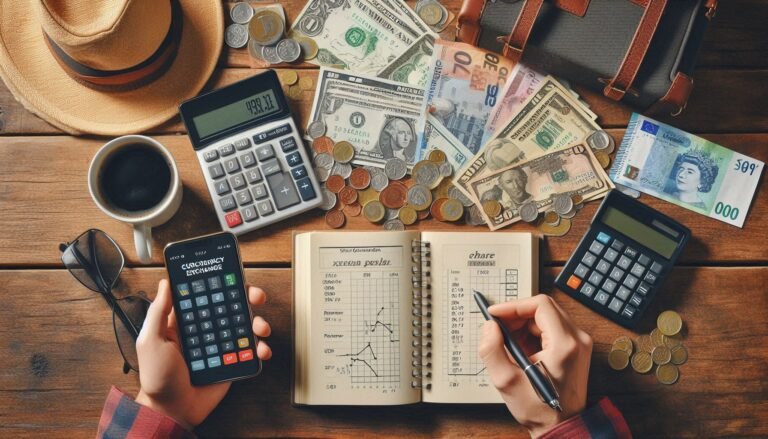

When exchanging currency, most people assume they’re getting a fair deal—especially when using a bank. But what many don’t realize is that banks often charge hidden fees that can significantly reduce the amount of money you receive.

These hidden charges are not always obvious, and banks rarely disclose them upfront, leaving customers unknowingly overpaying for currency exchange. In this article, we’ll uncover the most common hidden fees, how they affect your transactions, and how to avoid losing money when exchanging currency.

1. The Exchange Rate Markup – The Biggest Hidden Fee

Many people think the exchange rate they see on financial news sites (like Google or XE.com) is the same rate they’ll get at the bank. This is not true.

Banks apply an exchange rate markup, which means they add a margin on top of the real exchange rate (known as the mid-market rate). This markup allows banks to profit from your transaction without you realizing it.

Example:

- The mid-market rate for USD to EUR is 1 USD = 0.92 EUR.

- Your bank offers 1 USD = 0.89 EUR.

- If you exchange $1,000, you lose €30 just because of the markup!

How to Avoid It:

- Compare exchange rates using platforms like Google, XE.com, or Wise before exchanging money.

- Use currency exchange providers that offer rates closer to the mid-market rate, such as Wise, Revolut, or OFX.

2. Foreign Transaction Fees – The Extra Charge on Card Payments

If you’re paying with your credit or debit card abroad, your bank may charge a foreign transaction fee—usually between 1% and 3% per transaction. This applies to:

- Purchases in foreign currency (restaurants, hotels, online shopping)

- ATM withdrawals in another country

Example:

- You spend $1,000 on vacation in Europe, and your bank charges a 3% foreign transaction fee.

- That’s an extra $30 lost just for using your card abroad.

How to Avoid It:

- Use a credit card with no foreign transaction fees, like those from Capital One, Chase Sapphire, or American Express Travel Cards.

- Consider a multi-currency account from providers like Revolut or Wise, which let you hold money in different currencies without extra fees.

3. ATM Withdrawal Fees – A Costly Surprise for Travelers

Using an ATM abroad may seem convenient, but many banks charge high withdrawal fees. These fees can include:

- Flat fees ($3–$5 per withdrawal)

- Percentage-based fees (1%–3% per withdrawal)

- Dynamic Currency Conversion (DCC) fees (more on this below)

Example:

- Your U.S. bank charges a $5 fee + 2% of the withdrawal amount.

- If you withdraw $500 abroad, you’ll pay $15 in fees—just to access your money.

How to Avoid It:

- Withdraw larger amounts at once to minimize fees.

- Use ATMs from global bank networks that waive foreign withdrawal fees.

- Consider travel-friendly bank accounts (such as Charles Schwab, which refunds ATM fees worldwide).

4. Dynamic Currency Conversion (DCC) – A Trick That Costs You More

When using your debit or credit card abroad, you may see an option at checkout:

“Would you like to pay in your home currency (USD) or local currency (EUR)?”

Choosing your home currency (USD) might seem easier, but it actually costs you more due to Dynamic Currency Conversion (DCC).

Why DCC is a Ripoff:

- The merchant applies their own exchange rate, which is often worse than your bank’s rate.

- You pay extra fees that are hidden in the converted price.

Example:

- You buy a $100 souvenir in Europe.

- Paying in USD instead of EUR means the merchant converts at a worse rate, charging you $105 instead of $100.

How to Avoid It:

- Always choose to pay in the local currency (EUR, GBP, JPY, etc.).

- Use a card with low forex fees to ensure better rates.

5. Wire Transfer Fees – Expensive for International Payments

If you send money internationally through a bank, you may encounter:

- Flat fees ($15–$50 per transfer)

- Exchange rate markups (like we mentioned earlier)

- Intermediary bank fees (for transfers passing through multiple banks)

Example:

- You send $1,000 to Europe through your bank.

- The bank charges a $40 wire transfer fee and a 2% markup on the exchange rate.

- You lose $60+ just in fees.

How to Avoid It:

- Use online money transfer services like Wise, OFX, or Revolut, which charge much lower fees.

- If using a bank, ask about fees in advance and compare providers.

6. Hidden Bank Fees on Currency Exchange Transactions

Even if you exchange currency in person at a bank, you may face additional hidden fees like:

- Service charges or commission fees (up to 5%)

- Minimum exchange amounts (forcing you to exchange more than you need)

- Hidden margin on top of the exchange rate

Example:

- You exchange $1,000 at your bank.

- The bank charges a 2% fee ($20) plus a worse exchange rate, costing you another $30.

- You end up losing $50+ in total.

How to Avoid It:

- Compare exchange rates from multiple sources before exchanging.

- Consider using an online currency exchange platform (like Wise or Revolut) for better rates.

Final Thoughts

Banks won’t tell you about these hidden fees, but now that you know, you can avoid unnecessary charges and keep more of your money.

By following these steps, you can save hundreds of dollars when exchanging currency!